I've actually been

quite looking forward to doing this. I have always been more interested in the grand picture of the markets, rather than in the usual day to day noise/nonsense. I have added a few more indexes to

my own watch list - the Spanish IBEX, the Italian Borsa, and the

Greek wheelbarrow (or whatever its called).

There is a market

outside of New York City.

The USA remains the

leading equity market – at least for now, but there are many other

markets that a good trader should also be aware of. This first post

will take a look at 10 of the big world indexes (the dow'30 will be

included).

We'll take a look at

the overall trend for each, and try to conclude where we are, and

where we might be headed.

All charts are monthly

candle type, and cover a 20 year time frame (currently as far back as

stockcharts provide).

*I had considered

adding the Indexes for the other 3 BRIC countries (Brazil, Russia,

India) , but I will leave that for another post. They are economies

that are still very different from the western world, and thus

arguably should be kept separate.

--

Okay, lets look at the

ten markets....

Greece – the Athex'60

If there is one index

that illustrates what 'end of the world' looks like, its the Greek

market. From a high of just over 6000 in late 1999 – with a

slightly lower high in 2007 of 5000, we are now at the near

apocalyptic level of 750. In just 4 years this market has lost around

85%. There really isn't much left of it.

The implications of

leaving the Euro, with a subsequent devaluation would be astounding.

With further declines to say..500...and a 50% devaluation across 1-3

years, the Greek index could fall to the equivalent of around

250..maybe even under 100 if the new Drachma subsequently failed.

France – CAC'40

Looks much like the

Greek index, has suffered a 45% fall since 2007. Considering the

state of the French/European economy a break above 4000 looks

unlikely. A break under 3000 would likely take the CAC to 2500. If

the European mess does unravel, then the CAC could be expected to

briefly test the 2000 level.

Germany – DAX'30

The German economy is

the strongest of the EU, and thus its not entirely surprising its one

of the better performing indexes. Yet even the DAX is lower than the

2007 high. A failure to break above the wedge of 7500 would be a real

concern for the bulls. A break under 5000, and that would be a

critical 'WATCH OUT...trouble ahead!', with a likely test of the 2009

low. A collapse of the EU itself would likely take the DAX back to

2500. Unthinkable to many..but that would be the level to look for.

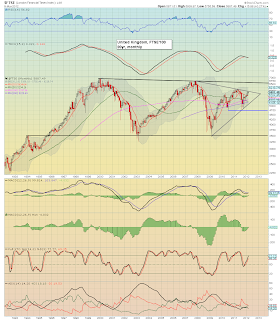

United Kingdom –

FTSE'100

Much like the German

DAX, a cleaner wedge..and is currently at resistance. A break above

6k would be bullish, a break under 5250 bearish – with a test of

4750 – if failed, then free fall to 3500.

Hong Kong – Hang

Seng'48

A huge decline since

the 2007 peak of 32000, but still some 100% higher than its 2009 low

of 11000. The Hang Seng faces a big problem at the 22/23,000 level.

So we're very close to determining where the mid term will go. A

break back under 16k would bode for scary times with a move back to

at least 13,000.

Spain – IBEX'35

With some of the

highest jobless numbers in the western world, the Spanish economy is

already way past the basket case stage. The index is still 50% below

its 2007 high, and although the last 9 months show some good support,

there is going to be severe resistance at the big 10,000 level A

break under 7500 opens up 7k, if that fails...then free-fall to 5k.

The EU imploding would likely take Spain back to 3k.

USA – DOW'30

Ahh yes, the mighty

DOW. One of the worlds strongest indexes (probably due to all that

paper printing!), we're less than 2000pts from the high. The current

trend is certainly upward, and there would be wedge/channel

resistance at the 14500 level – interesting double top possibility

huh? A break under 11k would be a real issue, and that would open

up10k – the 200 MA. If that failed to stop the selling, then a move

to the channel line around 7500/8000 in late 2012/2013 would be the

best target for the doomers.

Italy – Borsa'40

One of the PIIGS, and a

real threat to EU stability in the next year. This index is still 65%

lower than the 2007 high! The current trend is a clear wedge, a break

above 20k would be a massively bullish. A break under the recent low

of 12750 would be bearish.

Japan – Nikkei'225

The nation of Japan

remains in a long term depression, the late 1980s high of 30000 is a

distant memory, and we're 65% below that. We could be in a bull flag

right now – the 2009 low of 7k looks good, but a move under 7500 by

end 2012 would cancel the flag. A move under 7k would possibly occur

if the populace awaken from the delusion that 'everything is gonna be

alright'. The demographic disaster of Japan can not be overstated.

The nation is quite simply dying out through lack of babies! The fact

they are chronically indebted (even if it is to themselves), only

adds to the problem.

China – the SSEC'50

China, having seen a

literal transformation from traditional agrarian economy to full

speed rampant capitalism in just 3 decades, is still massively higher

than its mid 1990s low of 300s – currently almost 9 times higher,

yet is still around 55% lower than the 2007 bubble peak.

The China index is

showing severe resistance against the wedge, a break over 2750 would

be bullish. Only a clear break under 1600 would suggest a possible

challenge to test the 1000 level.

Indexes - Summary

Greece: End of the

world down trend continues...likely to lose another 75% of current

value

France: Overall down

trend since 2007, looking for a failure around 3500, then break 2750

German: showing some

strength, a break above 7500 would be significant.

UK: at critical

resistance, must break higher within 1-3months, or 20% decline viable

Hong Kong: approaching

critical wedge apex, currently showing slight weakness

Spain: still weak, a

failure to clear the 10MA would be severely bearish, with 40% decline

USA: still trying to

battle back to the 2007 bubble peak, but a possible H/S formation is

bearish

Italy: general

decline, possibly failing at the 10MA, 20% fall would be very viable

Japan: long term

decline, but 2 year bull flag offers promise in near term

China: declining, but

could easily break higher, and significant upside is possible

In Closing

Many indexes are still

massively lower than their 2007 bubble peaks. Many markets are also

at, or near critical wedge resistance levels. The unravelling of the

European Union – via 1 or more of the PIIG nations quitting the

Euro would be the ideal catalyst that the doomers are clearly looking

for.

China and Germany are

the stand-out markets. Both have more soundly manufacturing based

economies, and would likely do well across the longer term. The USA –

despite being one of the strongest markets out there, is likely a

result of the Bernanke money making machine, that has helped to prop

up asset prices across the board.

The rest of 2012 will

be very fascinating to see play out. Will the Euro zone hold together

– with at least some moderate level of growth – in which case

indexes could all break up and out of their wedges, with a strong end

to 2012. Or will any of the bigger PIIGs default, and/or leave the

Euro/EU, with resulting capital flow mayhem?

I hope those ten charts

helps emphasise the bigger picture, not least the point that we are

nearing a critical time where we'll either see much stronger equity

prices, or declines of somewhere between 20-40%.

Good wishes!

No comments:

Post a Comment