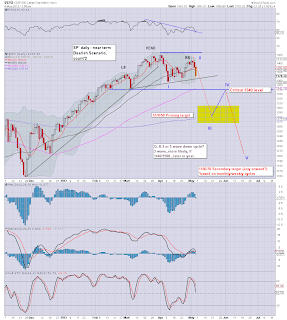

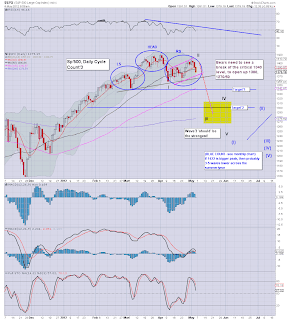

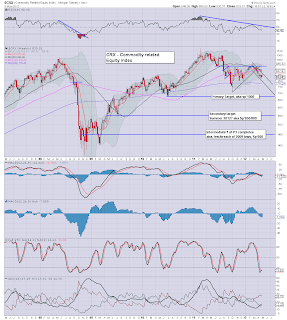

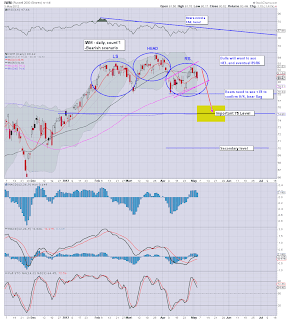

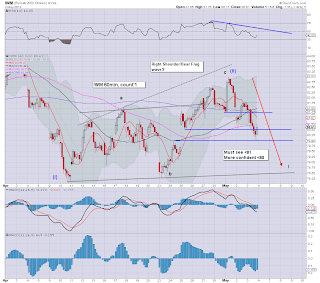

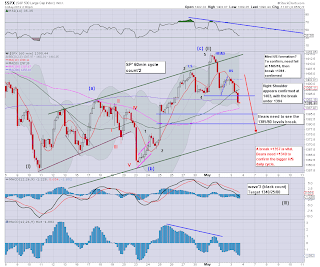

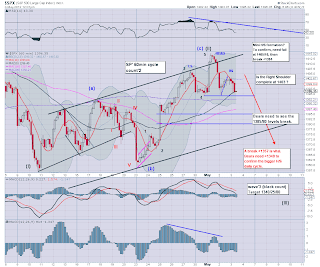

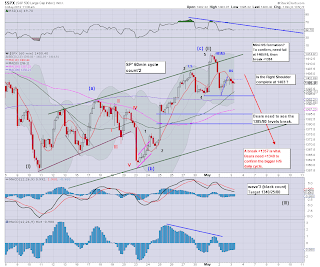

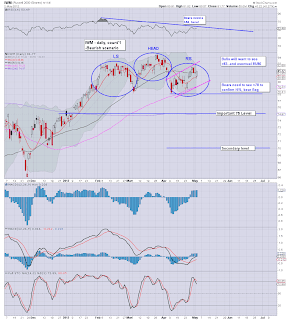

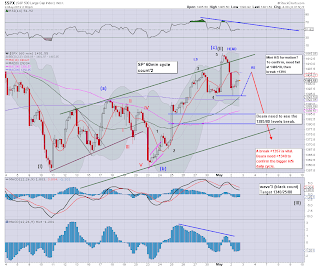

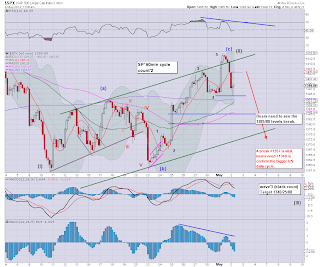

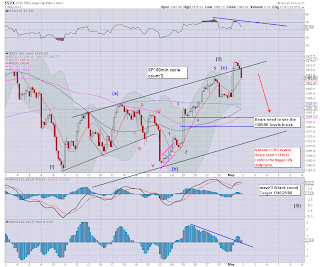

We're only down to around the low 1370s, but its a pretty damn good way to end the week. The mini H/S formation is confirmed. The great H/S formation on the daily cycle will also be confirmed if we break around 1340 - or 1365/60..depending on how generous you wish to be to the bulls.

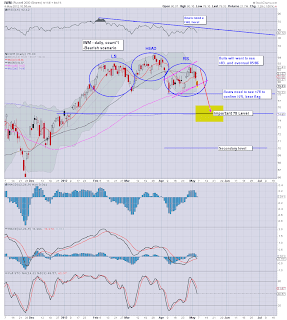

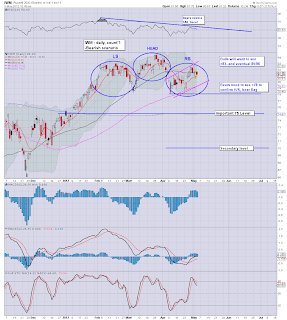

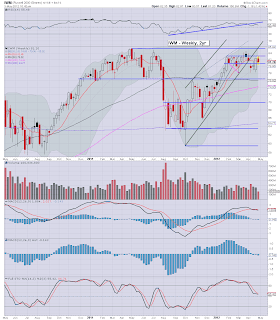

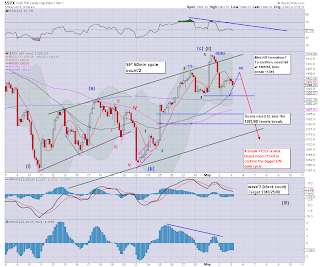

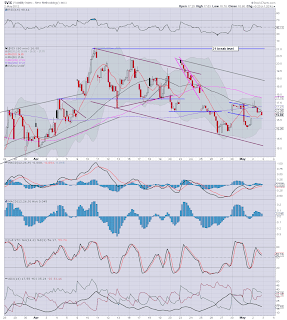

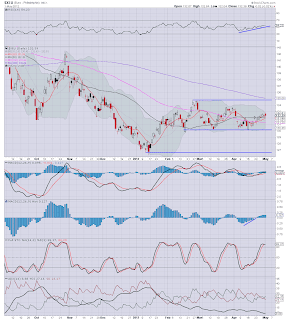

The VIX is finally showing some significant upside, but it still is not quite enough to get hyper-bearish yet.

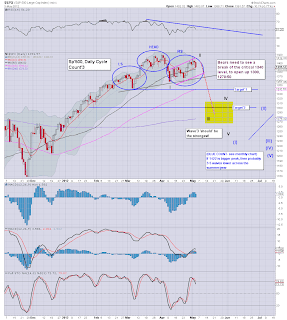

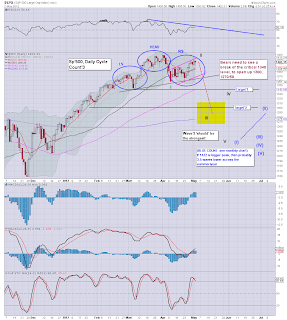

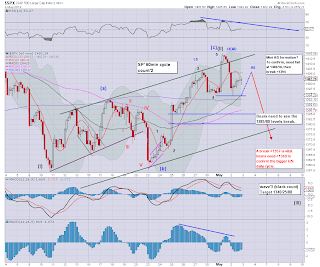

Sp' daily, bearish' count2

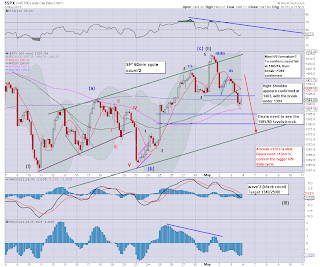

VIX, 60min

As is often the case, the question now is....'who wants to risk holding long across the long weekend?'. I'd expect weakness across the afternoon, but especially in the closing hour.

*as I post this...we did briefly break 1370.... 1369..is a very good sell-signal. 30pts open-air to go :)

Things are indeed looking good for the bears...more across the afternoon.

The VIX is finally showing some significant upside, but it still is not quite enough to get hyper-bearish yet.

Sp' daily, bearish' count2

VIX, 60min

As is often the case, the question now is....'who wants to risk holding long across the long weekend?'. I'd expect weakness across the afternoon, but especially in the closing hour.

*as I post this...we did briefly break 1370.... 1369..is a very good sell-signal. 30pts open-air to go :)

Things are indeed looking good for the bears...more across the afternoon.