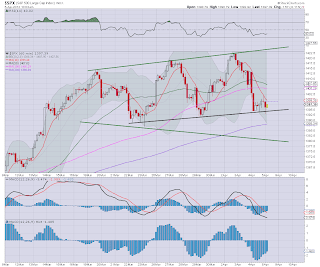

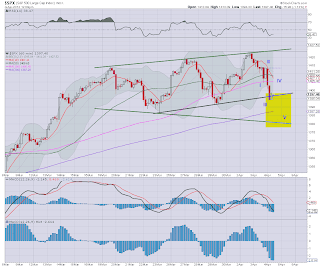

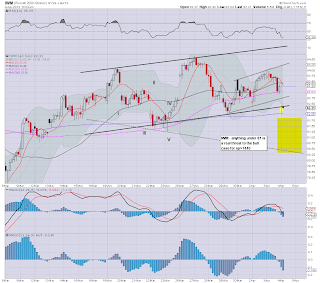

The Rus'2000 small cap index is suggesting a clear inverse head/shoulders formation is now complete, and with the indexes all ready to snap UP.

IWM, daily, rainbow chart

Bulls - who are brave enough to hold Long across a 3 day weekend, might do very well with a giant Monday gap up. Of course...no guarentees in this casino.

Conversely, Bears need to see a break under 81..and preferably 80.00 early next week. A break under 80 would probably result in 76.

The main problem which the bears face are that the World indexes (see my post from last weekend) are all suggesting UP, as are the same indexes from a daily cycle perspective.

-

Target on IWM - assuming it is an inv. H/S, would be somewhere around 88/92 within a couple months.

More after the close.

10am Update

Good morning all!

Okay...a little scare for the bulls pre-market..but we do seem to be holding here very well -whilst the cycles are resetting themselves for the next up move into next week.

Sp'60min

IWM

Summary

Best case - market has floored, and now we'll trundle around today - probably not too much either way, and then we await Fridays jobs data.

Best case bulls...we'll move into Monday will a significant gap upward..maybe even straight over sp'1422..which would cause a pretty serious stop reverse-cascade upward. That would easily open the door to 1440 as early as the end of next week.

Worse case for the bulls, currently would be a break lower Monday, <80 on IWM, and sp 1370s. If that is the case, then the overall bull case (sp'1550 by July - which I currently hold to) would be in critical threat..and the top may instead be in for the year.

*I remain long, and will hold across the long weekend. Coming from a Permabear, maybe that says something.

*Futures and Bond markets will be open Friday, whilst NYSE is closed.

More later in the day.

Okay...a little scare for the bulls pre-market..but we do seem to be holding here very well -whilst the cycles are resetting themselves for the next up move into next week.

Sp'60min

IWM

Summary

Best case - market has floored, and now we'll trundle around today - probably not too much either way, and then we await Fridays jobs data.

Best case bulls...we'll move into Monday will a significant gap upward..maybe even straight over sp'1422..which would cause a pretty serious stop reverse-cascade upward. That would easily open the door to 1440 as early as the end of next week.

Worse case for the bulls, currently would be a break lower Monday, <80 on IWM, and sp 1370s. If that is the case, then the overall bull case (sp'1550 by July - which I currently hold to) would be in critical threat..and the top may instead be in for the year.

*I remain long, and will hold across the long weekend. Coming from a Permabear, maybe that says something.

*Futures and Bond markets will be open Friday, whilst NYSE is closed.

More later in the day.

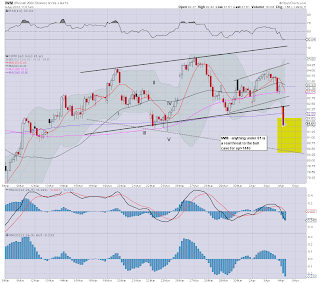

Dollar - bouncing on the rising channel

The Dollar is suggestive of a new up-cycle . a potentially major one.

UUP - non-leveraged $ ETF, weekly cycle

Looks pretty bullish, from a cycle point of view, we are only 1-2 weeks away from going +cycle (MACD blue bar histogram), where a major snap move higher is viable*

*The weekly VIX chart is similarly suggestive of a possible snap higher move within the next 1-3 weeks.

So, the bears have both the $ and the VIX weekly cycles on their side, but they need follow through next week!

$ Implications, if the trend continues

Bearish on all commodities, especially the precious metals - causing SLV/GLD to snap much lower

Bearish on commodity related equities, in particular, the mining sector.

General downward pressure on the main market.

Good wishes for Thursday trading (a day we need to treat as a Friday!)

UUP - non-leveraged $ ETF, weekly cycle

Looks pretty bullish, from a cycle point of view, we are only 1-2 weeks away from going +cycle (MACD blue bar histogram), where a major snap move higher is viable*

*The weekly VIX chart is similarly suggestive of a possible snap higher move within the next 1-3 weeks.

So, the bears have both the $ and the VIX weekly cycles on their side, but they need follow through next week!

$ Implications, if the trend continues

Bearish on all commodities, especially the precious metals - causing SLV/GLD to snap much lower

Bearish on commodity related equities, in particular, the mining sector.

General downward pressure on the main market.

Good wishes for Thursday trading (a day we need to treat as a Friday!)

Shiny things...still suffering

Another rough day for the metals (those gold bugs will sure be getting mad!)

GLD, daily, near term

Weak weak...WEAK. There is nothing good about this chart, its headed for 150..and probably 120 later in the year.

SLV, daily, near term

SLV close to the precipice. The key $30 level..so close to being taken out today, but it did hold!

Bullish case...$30 holds .. offering a possible inverse H/S ? I'm not sure what that might imply for a target...but surely at least 34/36..near term.

Bearish case....if 30 fails..then immediate - and fast move to 25/26.

-

As stated many times in the past few weeks, metals are bearish in the mid term, with targets of $1200 and $20 respectively.

GLD, daily, near term

Weak weak...WEAK. There is nothing good about this chart, its headed for 150..and probably 120 later in the year.

SLV, daily, near term

SLV close to the precipice. The key $30 level..so close to being taken out today, but it did hold!

Bullish case...$30 holds .. offering a possible inverse H/S ? I'm not sure what that might imply for a target...but surely at least 34/36..near term.

Bearish case....if 30 fails..then immediate - and fast move to 25/26.

-

As stated many times in the past few weeks, metals are bearish in the mid term, with targets of $1200 and $20 respectively.

Weekly Cycle Update

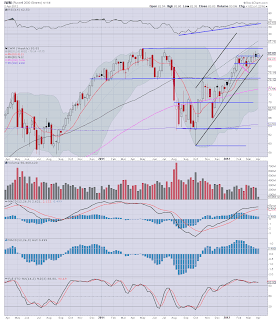

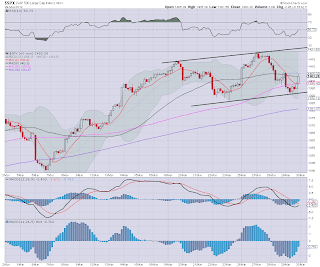

Weekly cycles are still generally positive, but some indexes are getting a little close to the cliff edge.

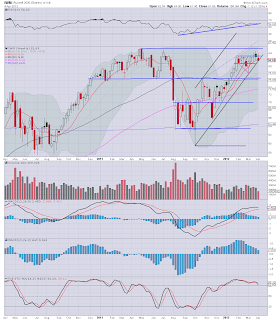

SP'

Right now - especially when you take into account the 60min cycle, SP'1380 would be acceptable as the lowest level, before the general bull trend/outlook gets into trouble.

IWM

Clearly, IWM is right on the edge. Also, the momentum cycle is starting to get kinda close to the 0 line - along with the sto' <80. Pretty weak.

As noted yesterday, bulls MUST see IWM break above the 86 level within a few weeks, in order to confirm that sp'1550 will be attained in the next few months.

A break below 81 - whether Thursday - or next Monday would be a real threat to the bull case, and a move under 80.00...would arguably be the first real warning to the bulls that the rally since last October is coming to an end.

Right now - especially when you take into account the 60min cycle, SP'1380 would be acceptable as the lowest level, before the general bull trend/outlook gets into trouble.

IWM

Clearly, IWM is right on the edge. Also, the momentum cycle is starting to get kinda close to the 0 line - along with the sto' <80. Pretty weak.

As noted yesterday, bulls MUST see IWM break above the 86 level within a few weeks, in order to confirm that sp'1550 will be attained in the next few months.

A break below 81 - whether Thursday - or next Monday would be a real threat to the bull case, and a move under 80.00...would arguably be the first real warning to the bulls that the rally since last October is coming to an end.

Closing Summary

Hmm..it was not exactly the most exciting end to the day, lets look at those hourly cycles...

SP'500

SP' already making a challenge to get back above the important 10MA. The MACD cycle looks like it has floored - and certainly the price action put in a good 5 hour floor today. However, even if we open up moderately positive Thursday, its likely going to take 3-5 hours just to get back to + cycle.

IWM

The Rus'2000 index is still weaker than just about all other indexes, but even this did put in some attempt of a bounce. Most bearish case would be some kinda overnight upset/bad Friday jobs data, and see this drop to around 80.00 by late Monday. The monthly cycle would strongly argue against that though, and the VIX is already looking maxed out.

VIX

VIX already on the decline, although it did put in a higher high today. Can the VIX hold positive cycle tomorrow, and break into the 18s?

Thursday (end of the trading week!)

The bulls don't necessarily need a strong Thursday. Even a flat day -whilst the cycles reset (especially the hourly) would be okay.

Best bull case:

SP +7/10pts, by late morning - before some highly probable retracement/re-test of the 1400/05 level.

IWM to around 82.50/75. The 83.00/ gap-fill levels seems kinda unlikely though.

*I am holding long - via IWM calls overnight. I'm prepared to hold into next week if tomorrow is largely flat.

If we open up (for whatever reason) strongly I'd look to sell into the open, and re-long later in the day at the base of the next 15min cycle sometime between 11am-2pm. I am still guessing the Friday jobs data will lead to the next major move up in the market.

More...somewhat later...

SP'500

SP' already making a challenge to get back above the important 10MA. The MACD cycle looks like it has floored - and certainly the price action put in a good 5 hour floor today. However, even if we open up moderately positive Thursday, its likely going to take 3-5 hours just to get back to + cycle.

IWM

The Rus'2000 index is still weaker than just about all other indexes, but even this did put in some attempt of a bounce. Most bearish case would be some kinda overnight upset/bad Friday jobs data, and see this drop to around 80.00 by late Monday. The monthly cycle would strongly argue against that though, and the VIX is already looking maxed out.

VIX

VIX already on the decline, although it did put in a higher high today. Can the VIX hold positive cycle tomorrow, and break into the 18s?

Thursday (end of the trading week!)

The bulls don't necessarily need a strong Thursday. Even a flat day -whilst the cycles reset (especially the hourly) would be okay.

Best bull case:

SP +7/10pts, by late morning - before some highly probable retracement/re-test of the 1400/05 level.

IWM to around 82.50/75. The 83.00/ gap-fill levels seems kinda unlikely though.

*I am holding long - via IWM calls overnight. I'm prepared to hold into next week if tomorrow is largely flat.

If we open up (for whatever reason) strongly I'd look to sell into the open, and re-long later in the day at the base of the next 15min cycle sometime between 11am-2pm. I am still guessing the Friday jobs data will lead to the next major move up in the market.

More...somewhat later...

Time for Lunch

Sp'60min - a count idea.

Looking for a move to 1405 at least within a few hours.

However, we might get stuck there, and rollover into the close, with a low tomorrow around 1390/85.

I don't see much chance of anything lower than that. As a few have noted, probably will just recycle back upward next week -as all the daily and monthly cycles suggest.

So, I look to bail at least over 1405 later, and re-long tomorrow at lower levels.

More later :)

Looking for a move to 1405 at least within a few hours.

However, we might get stuck there, and rollover into the close, with a low tomorrow around 1390/85.

I don't see much chance of anything lower than that. As a few have noted, probably will just recycle back upward next week -as all the daily and monthly cycles suggest.

So, I look to bail at least over 1405 later, and re-long tomorrow at lower levels.

More later :)

11am update

*I guess I'm in the mood to post a lot these past few days!

--

I'm guessing we have floored, at least for a few hours.

IWM

*I am long from IWM 81.79. It should be okay for at least a bounce to the 10MA - which is of course falling quite rapidly..

target, by end day : 82.50/75

-

SP

Sp' still stronger than IWM.

-

From a cycle perspective, we're pretty much exhausted, at least for a few hours.

I will exit longs, if we can get a good enough bounce. 82.50 would be a worthwhile exit, and come back tomorrow. maybe for an even better entry lower down, before the Friday jobs data.

-

good wishes..for what is..quite an interesting day.

--

I'm guessing we have floored, at least for a few hours.

IWM

*I am long from IWM 81.79. It should be okay for at least a bounce to the 10MA - which is of course falling quite rapidly..

target, by end day : 82.50/75

-

SP

Sp' still stronger than IWM.

-

From a cycle perspective, we're pretty much exhausted, at least for a few hours.

I will exit longs, if we can get a good enough bounce. 82.50 would be a worthwhile exit, and come back tomorrow. maybe for an even better entry lower down, before the Friday jobs data.

-

good wishes..for what is..quite an interesting day.

10am update

good morning

Everything on track...

sp'60min

iwm 60min

I'm a buyer once i see some price stability, and the MACD cycle level out.

That might take a few more hours.

There is no hurry.

-

*Bears going heavy short, and getting hysterically excited about a 'big move lower', are likely going to get their arms ripped off.

Everything on track...

sp'60min

iwm 60min

I'm a buyer once i see some price stability, and the MACD cycle level out.

That might take a few more hours.

There is no hurry.

-

*Bears going heavy short, and getting hysterically excited about a 'big move lower', are likely going to get their arms ripped off.

Metals..still under relentless attack

Both Gold and Silver suffered after Tuesdays FOMC press release

GLD monthly, 2yr outlook

A break under $1550 should open up $1200 later this year. I admit its a very bold outlook, - and it assumes massive $ strength later in the year - primarily due to renewed EU concerns and general 'flight to safety'.

SLV, monthly, 2yr outlook

Silver already below what I'd argue was the important 10MA line to hold over. First target remains $25, and I'm guessing that won't hold either.

The deflationary view

The precious metals will continue to weaken if the economic weakness/deflationary outlook is correct. Despite a lot of further QE3 talk, metals are still weak. Can you imagine how the metals would react if the Bernanke officially announced 'no more QE for the foreseeable future?'.

Long term, metals remain the ultimate 'physical' holdings, but near term...the trend lower looks set to continue.

Good wishes.... (and keep stacking)

GLD monthly, 2yr outlook

A break under $1550 should open up $1200 later this year. I admit its a very bold outlook, - and it assumes massive $ strength later in the year - primarily due to renewed EU concerns and general 'flight to safety'.

SLV, monthly, 2yr outlook

Silver already below what I'd argue was the important 10MA line to hold over. First target remains $25, and I'm guessing that won't hold either.

The deflationary view

The precious metals will continue to weaken if the economic weakness/deflationary outlook is correct. Despite a lot of further QE3 talk, metals are still weak. Can you imagine how the metals would react if the Bernanke officially announced 'no more QE for the foreseeable future?'.

Long term, metals remain the ultimate 'physical' holdings, but near term...the trend lower looks set to continue.

Good wishes.... (and keep stacking)

No Fear

There is no fear in this market. None. I suppose some would say that is the sign of a market top, but hey...the 'no fear' stage can last months..as we've already seen a number of times in the last 3 years.

Despite today's afternoon market decline, the VIX closed barely up.

VIX, rainbow chart, daily, near term

Baring a major move lower, it does not look like VIX is going to go much above 17.or 18 by Thursday. By then of course the cycle will arguably be complete, and that sets up for another wave lower for the VIX starting next Monday.

VIX weekly - momentum still crawling back up

A lot of posters out there do point out the giant wedge that the VIX is displaying, but still...the 'floor' could last many months..easily into the June/July period which is where my index highs (SP'1550) would be.

Until VIX breaks above 20...any moves are unreliable, and to be treated as minor..and completely irrelevant noise.

Goodnight

Despite today's afternoon market decline, the VIX closed barely up.

VIX, rainbow chart, daily, near term

Baring a major move lower, it does not look like VIX is going to go much above 17.or 18 by Thursday. By then of course the cycle will arguably be complete, and that sets up for another wave lower for the VIX starting next Monday.

VIX weekly - momentum still crawling back up

A lot of posters out there do point out the giant wedge that the VIX is displaying, but still...the 'floor' could last many months..easily into the June/July period which is where my index highs (SP'1550) would be.

Until VIX breaks above 20...any moves are unreliable, and to be treated as minor..and completely irrelevant noise.

Goodnight

Tuesday Weekly Update

Alrighty...lets check those weekly cycles

IWM weekly..

IWM remains really still stuck under the important 86 level. In the next wave up..it will be paramount for IWM to catch a real surge and decisively break through this level. A break over 86..should open up 90/92 (at least). The Fib' level suggest...105 - which right now of course, seems impossibly out of reach.

Near term, IWM really should not break under the 81 level. 82 might be as low as we go - today's closing hour rebound may support that idea.

What is clear, a break under 80, opens up 76..and a whole lot of trouble for the still upward trend in the monthly cycle.

SP' weekly

SP'500...still a straight up move. Even a move to the 10MA at 1370 would really not do any real damage to the ultimate bullish target of 1550.

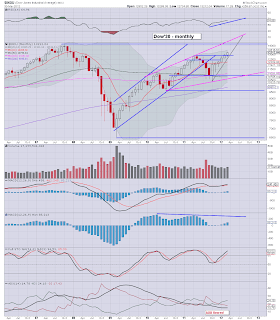

Dow, weekly

The lower channel line is probably drawn a bit tight. It should probably include the 13,000 level. So, I'd say only a move under 13k tomorrow or Thursday would be a problem for the bullish case.

Summary

Today was interesting to watch, but still..its all minor moves. There really haven't been any major down days occurring yet. I'm guessing - especially if you look at the IWM chart, its all just a giant inverse H/S formation, and we'll explode upward starting next Monday. If that's the case of course, then the bears who are getting mildly hysterical will be furious, dismayed..and again, see their positions wiped away.

I intend to go long no later than the Thursday close. Its certainly not a risk-free trade, across a 3 day Easter-bunny weekend, but if the 60min cycle is really low...I'll play it Long. Until the bigger cycles turn lower, the default trade (at the base of every 60min cycle) remains Long.

More later...perhaps.

IWM weekly..

IWM remains really still stuck under the important 86 level. In the next wave up..it will be paramount for IWM to catch a real surge and decisively break through this level. A break over 86..should open up 90/92 (at least). The Fib' level suggest...105 - which right now of course, seems impossibly out of reach.

Near term, IWM really should not break under the 81 level. 82 might be as low as we go - today's closing hour rebound may support that idea.

What is clear, a break under 80, opens up 76..and a whole lot of trouble for the still upward trend in the monthly cycle.

SP' weekly

SP'500...still a straight up move. Even a move to the 10MA at 1370 would really not do any real damage to the ultimate bullish target of 1550.

Dow, weekly

The lower channel line is probably drawn a bit tight. It should probably include the 13,000 level. So, I'd say only a move under 13k tomorrow or Thursday would be a problem for the bullish case.

Summary

Today was interesting to watch, but still..its all minor moves. There really haven't been any major down days occurring yet. I'm guessing - especially if you look at the IWM chart, its all just a giant inverse H/S formation, and we'll explode upward starting next Monday. If that's the case of course, then the bears who are getting mildly hysterical will be furious, dismayed..and again, see their positions wiped away.

I intend to go long no later than the Thursday close. Its certainly not a risk-free trade, across a 3 day Easter-bunny weekend, but if the 60min cycle is really low...I'll play it Long. Until the bigger cycles turn lower, the default trade (at the base of every 60min cycle) remains Long.

More later...perhaps.

Initial closing brief

Hey people..

well that was quite an interesting post FOMC bit of action...

IWM finally snapped lower, but the closing hour saw a little rebound. I've added a few possible channel lines - maybe we're in an expanding wedge, with a lower channel as low as 80.00 by Thursday

IWM 60min

The 60min momentum could easily crawl lower all of Wednesday.

Provisionally speaking, this last hour up seems like a fake-out, looking for new lows tomorrow, probably at least down to 82.00

--

*to be clear, I still think this is just another cruel tease to the bears, with major up moves next Monday onward.

more later!

well that was quite an interesting post FOMC bit of action...

IWM finally snapped lower, but the closing hour saw a little rebound. I've added a few possible channel lines - maybe we're in an expanding wedge, with a lower channel as low as 80.00 by Thursday

IWM 60min

The 60min momentum could easily crawl lower all of Wednesday.

Provisionally speaking, this last hour up seems like a fake-out, looking for new lows tomorrow, probably at least down to 82.00

--

*to be clear, I still think this is just another cruel tease to the bears, with major up moves next Monday onward.

more later!

Down cycle ..50% complete

Whilst his highness.. Lord Obama is speaking live, via clown channel...lets take a look at the sp'

SP' 60min cycle

Target...1405..maybe 1400...sometime tomorrow..or Thursday.

Its possible we might get a little bounce for a few hours late today/Wednesday..but that the full cycle will floor out by Thursday.

As it is, I'm looking to go re-LONG, around sp'1405 or lower.

Patience...its something I still struggle with..but so far today,,doing okay...doing nothing :)

SP' 60min cycle

Target...1405..maybe 1400...sometime tomorrow..or Thursday.

Its possible we might get a little bounce for a few hours late today/Wednesday..but that the full cycle will floor out by Thursday.

As it is, I'm looking to go re-LONG, around sp'1405 or lower.

Patience...its something I still struggle with..but so far today,,doing okay...doing nothing :)

Minor cycle...down underway

morning update

Well the Factory orders data is out of the way....next up ...ADP jobs data tomorrow morning.

-

15min cycle floored - from a momentum view

60min cycle...could trundle down ALL day..and into early Wednesday.

-

SP'60min

Only a move under 1400..preferably 1395 would be moderately bearish.

The BIG weekly and monthly cycles are still saying UP UP UP.

*also a special note, all those monthly world-index cycles I covered at the weekend, many are indeed going + cycle, and triggering buy signals for those algo-bots.

**world indexes are also floored on the daily cycles.

-

Well the Factory orders data is out of the way....next up ...ADP jobs data tomorrow morning.

-

15min cycle floored - from a momentum view

60min cycle...could trundle down ALL day..and into early Wednesday.

-

SP'60min

Only a move under 1400..preferably 1395 would be moderately bearish.

The BIG weekly and monthly cycles are still saying UP UP UP.

*also a special note, all those monthly world-index cycles I covered at the weekend, many are indeed going + cycle, and triggering buy signals for those algo-bots.

**world indexes are also floored on the daily cycles.

-

The Bearish Outlook

Good morning

There is a fair bit of chatter out there at the moment, bears are obviously desperate for a down cycle..we might get one across the next few days (ala' holiday reversal), but it might only be 2%.taking us back to sp'1410/05.

The notion that we fall anything more than 3-4% seems...unlikely. We have the jobs data on Friday, so if we do sell off a tiny bit..and we're hovering around 1400/05 - with the 60min cycle floored, I'll be a buyer there.

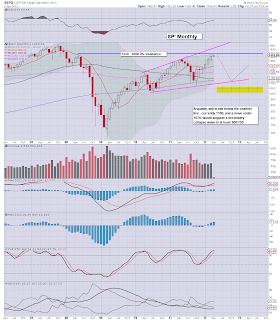

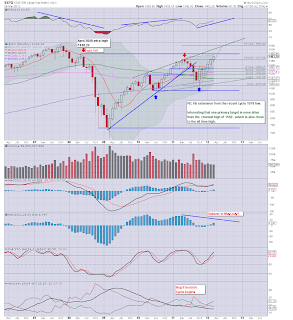

SP monthly cycle - bearish outlook

Here is a really simple chart, clearly the current cycle remains UP. However, we're now at month number'7 into this cycle, and you can see the previous up cycles were roughly this kinda length -before a multi-month retracement.

1440 is indeed a VERY important line, I still believe if we can get a few closes over 1440, then 1550 - by July is a given.

-

*As I type, AAPL is already +$5 pre-market, despite the main indexes being -0.25% generally.

Good wishes for Tuesday trading!

There is a fair bit of chatter out there at the moment, bears are obviously desperate for a down cycle..we might get one across the next few days (ala' holiday reversal), but it might only be 2%.taking us back to sp'1410/05.

The notion that we fall anything more than 3-4% seems...unlikely. We have the jobs data on Friday, so if we do sell off a tiny bit..and we're hovering around 1400/05 - with the 60min cycle floored, I'll be a buyer there.

SP monthly cycle - bearish outlook

Here is a really simple chart, clearly the current cycle remains UP. However, we're now at month number'7 into this cycle, and you can see the previous up cycles were roughly this kinda length -before a multi-month retracement.

1440 is indeed a VERY important line, I still believe if we can get a few closes over 1440, then 1550 - by July is a given.

-

*As I type, AAPL is already +$5 pre-market, despite the main indexes being -0.25% generally.

Good wishes for Tuesday trading!

Weekly Wonders

Just another little brief look...this time..the weekly cycles

IWM weekly

I would get concerned if IWM breaks below 82 at any point this week. A break under 82..would open up as move to as low as 76 - roughly a 10% move...aka..SP'1300.

SP' weekly

SP' is far more stronger than the Rus'2000 (aka, IWM), even though momentum IS lessening, we are still positive cycle, and there is ZERO sign of levelling out, never mind any rollover.

-

*VIX - weekly. I won't even bother posting a weekly VIX chart, just seems pointless. The daily moves are all noise, and until I see it above 20' is doesn't seem to merit any serious attention right now.

-

So, today was another up day, and the weekly cycle is continuing the same low volume melt up. Only a complete maniac would be heavy short right now.

Good wishes

IWM weekly

I would get concerned if IWM breaks below 82 at any point this week. A break under 82..would open up as move to as low as 76 - roughly a 10% move...aka..SP'1300.

SP' weekly

SP' is far more stronger than the Rus'2000 (aka, IWM), even though momentum IS lessening, we are still positive cycle, and there is ZERO sign of levelling out, never mind any rollover.

-

*VIX - weekly. I won't even bother posting a weekly VIX chart, just seems pointless. The daily moves are all noise, and until I see it above 20' is doesn't seem to merit any serious attention right now.

-

So, today was another up day, and the weekly cycle is continuing the same low volume melt up. Only a complete maniac would be heavy short right now.

Good wishes

Another Bullish Monday

Okay... not the most exciting of days, but it'll do. The early minor opening decline...as expected..failed..and then another slow motion melt up. I can only imagine how annoyed some of the bears were again with today. There are such a lot of dire econ-news stories out there right now - especially about Spain, but the markets are relentless.

Sp'60min cycle...

VIX' 60min

VIX, double cycle lower, trying.. to claw up..but could just easily fail again at the Tuesday open. Again, whilst we're still under 20, this is all noise.

Tuesday?

The hourly index cycles look toppy, but we could easily open up again Tuesday. I'm not meddling.. I dropped a call block earlier, so..no positions to start tomorrow. There is econ-data all this week..including the big jobs data Friday -but we're closed then anyway.

more later...probably.

Sp'60min cycle...

VIX' 60min

VIX, double cycle lower, trying.. to claw up..but could just easily fail again at the Tuesday open. Again, whilst we're still under 20, this is all noise.

Tuesday?

The hourly index cycles look toppy, but we could easily open up again Tuesday. I'm not meddling.. I dropped a call block earlier, so..no positions to start tomorrow. There is econ-data all this week..including the big jobs data Friday -but we're closed then anyway.

more later...probably.

Smaller cycles..are maxed

Brief update...

exited calls earlier..so..now I'm watching....

SP'60min cycle

Tempting to take a short position this afternoon, but primary trend remains UP

More later.

exited calls earlier..so..now I'm watching....

SP'60min cycle

Tempting to take a short position this afternoon, but primary trend remains UP

More later.

Big Bear is still in warm and fuzzy mood

It is another sleepy Sunday in the city of London, despite the glorious sunshine, there is still a little chill in the air. Yet those 'Green Shoots' sure are appearing everywhere. Soon the city will look its finest, before the long decay all the way into the grey and depressing winter.

I noticed this short video earlier....

http://www.liveleak.com/view?i=0d7_1333291679

It is always somewhat bizarre to see such a huge animal acting so playful and sweet. The 'market bear' (would its name be Pee-Three?), has indeed been very playful and happily submissive since last October.

How many more months of the warm and fuzzy bear to go?

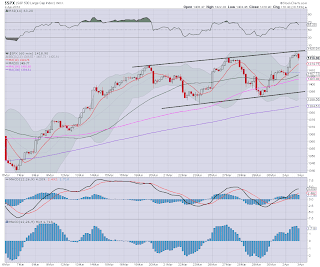

Lets take a look at the Sp'500, monthly

Ask anyone - not part of the chart fraternity 'which way is this market headed?', and they'd doubtless say up. The chart above is about as simple as it gets. I'm just assuming the current wave takes us to the upper channel line that was established from May'2010 to May'2011. I realise many out there will get all riled up over such a simplistic outlook, but hey...I like simple. I have added a standard Fib' extension, which interestingly points to the 1550 target.

As I've posted a few times in the last few days, I'm real tired of things. I'm real tired of overly complicated theories, of counts (yeah, I'm guilty of that a bit), and just plain relentless 'top calling'. I'm sticking with simple, its as.....err....simple as that really.

Spin the Wheel

The Futures wheel spins up in 5 hours, lets see if they wanna tease the big bear with a little down move of say 0.5/0.75%...or, if they wanna whack him in the head with a wooden bat...aka.. SP+12/15pts (for no good reason). New week, new month...new quarter. Lets hope its at least...entertaining :)

Enjoy the evening.

I noticed this short video earlier....

http://www.liveleak.com/view?i=0d7_1333291679

Mr Bear will not always be so playful..this year

It is always somewhat bizarre to see such a huge animal acting so playful and sweet. The 'market bear' (would its name be Pee-Three?), has indeed been very playful and happily submissive since last October.

How many more months of the warm and fuzzy bear to go?

Lets take a look at the Sp'500, monthly

Ask anyone - not part of the chart fraternity 'which way is this market headed?', and they'd doubtless say up. The chart above is about as simple as it gets. I'm just assuming the current wave takes us to the upper channel line that was established from May'2010 to May'2011. I realise many out there will get all riled up over such a simplistic outlook, but hey...I like simple. I have added a standard Fib' extension, which interestingly points to the 1550 target.

As I've posted a few times in the last few days, I'm real tired of things. I'm real tired of overly complicated theories, of counts (yeah, I'm guilty of that a bit), and just plain relentless 'top calling'. I'm sticking with simple, its as.....err....simple as that really.

Spin the Wheel

The Futures wheel spins up in 5 hours, lets see if they wanna tease the big bear with a little down move of say 0.5/0.75%...or, if they wanna whack him in the head with a wooden bat...aka.. SP+12/15pts (for no good reason). New week, new month...new quarter. Lets hope its at least...entertaining :)

Enjoy the evening.

World Stock Indexes - End'Q1

Its that time of the month, lets take a grand overview of ten of the worlds leading stock indexes.

Greece – the Athex'60

After a strong opening to the year - with February showing some brief follow through, Greece ended March slightly weaker, the much bigger down trend remains entirely intact. Even a move to the 10MA - or even a touch above, by early summer is almost certain to fail. This market is already past the 'Armageddon' phase, there is only 15% or so left. In the scheme of things, the Greek market is already over.

France – CAC'40

France is a key market to watch, and I believe its going to be vital to closely monitor across the next 3 months. It should give USA traders a warning as to if this post-October rally will keep on going...or rollover.

The CAC'40 at 3423 presently, will face SEVERE resistance around 3700 by late June/July. This of course is the time I expect the US markets to be peaking around 1550. Also, a move of 10% in the CAC, would match up perfectly with a further 8-10% in the SP' index. Things are really looking in sync' across a number of world indexes.

Of special note, the MACD (green bar histogram), will be very close to going positive cycle by mid April, and there should be a bullish cross of the MACD red/black lines. So, everything is set up for one final burst upward. One final thing that you can see in terms of the MACD, we've have two broad up cycles since the 2009 low. The coming third tower/+ cycle will be much smaller, and we should see a confirmed rollover by August/September. That would bode very well for at least a 3-6 month down cycle in the main indexes.

Germany – DAX'30

Germany has had a great first quarter - even though it was a difficult March for the EU, and ended positive. If there is one index in Europe that can break out to much higher levels, it is Germany. The MACD cycle will almost certainly go positive cycle at the beginning of next week - providing a pretty huge buy signal for the algo-bots for April and into early summer.

There will be strong double-top resistance around the 7600 level in the next few months. I'd guess we will fail there, and even the strongest EU nation/market will rollover in the latter part of the year.

United Kingdom – FTSE'100

The FTSE index had a moderately weak March, but the underlying trend is still positive, and just like Germany, looks set to go positive cycle in early April. I'd guess the FTSE is likely to go above the May'2011 highs, with a target around 6200/6400. That would again match up with the overall SP'1550 target, no later than July.

Hong Kong – Hang Seng'48

A weak month for Hong Kong, losing 5%, but underlying trend still looks upward (although weakening). A target of around 22/23k would seem the very best that the bulls can aim for.

Spain – IBEX'35

Spain is one of the weakest EU markets, a real economic basket case. With 50% youth unemployment, we have seen just this past week increasing social unrest. The Spanish people are getting moody, and with summer coming, it will only get much more 'dynamic' there. Bullish fire extinguishers, glazing companies, and rock miners?

The IBEX is very weak at 8000, however there is pretty easy upside to the 10MA around 8800. That's a good 10%..and again..this would match up with Sp'1550 by June/July. Eventually, I'd foresee the IBEX breaking under 7k..and that opens the door to a fast plunge to 5k.

USA – DOW'30

Six straight months up for the Dow, and it remains arguably the worlds strongest index. The MACD cycle has been positive for the past 3 months, and a few more positive months seem highly probable. In terms of price action, next target is upper bol' 13500, then a test of the 2007 bubble high of 14198. It is entirely possible that the dow will make a new high..briefly..as high as 14500/700 by July. A new dow high, to coincide with a facebook IPO? That would make for a near perfect marker point for a top.

Italy – Borsa'40

Italy is weak, but a test of the declining channel line around 17500 seems probable. The underlying MACD cycle looks set to go + cycle in April.

From a bigger perspective, you can see that Italy is still some 65% lower than the 2007 bubble era. A truly epic 'waste of time' for the buy & hold Italian investor. The Italian market is broken, and what will be very curious to watch is what happens if we break below the 13k level.

Japan – Nikkei'225

The bull flag that I mentioned in the first world-index report has been marginally broken above. First target remains 11k, and -assuming the bigger bearish outlook is correct, the 11k resistance will hold, with a move to the lower channel line of around 6k sometime in 2013.

China – the SSEC'50

There is an incessant amount of China doom talk out there. Even a Zerohedge posting on Friday was suggesting a China market crash is viable. Indeed it is, but - considering the near term outlook for the other world indexes, I believe it won't happen until at least Q3, or more likely Q4.

A move as high as 2600 seems viable in the coming few months, but it looks highly improbable that it can break and hold over the next huge psy' level of 3000. Just like in Italy, the really curious aspect is what happens if we break below 1700 - it would open the door to a further 45% fall to 1000. That will not please the amateur Chinese trader..they've had a rough 5 years already (down around 60%)..a move to 1000 would be a fall of 85% from the bubble peak. China social uprising in 2013?

In Closing

Greece – the Athex'60

After a strong opening to the year - with February showing some brief follow through, Greece ended March slightly weaker, the much bigger down trend remains entirely intact. Even a move to the 10MA - or even a touch above, by early summer is almost certain to fail. This market is already past the 'Armageddon' phase, there is only 15% or so left. In the scheme of things, the Greek market is already over.

France – CAC'40

France is a key market to watch, and I believe its going to be vital to closely monitor across the next 3 months. It should give USA traders a warning as to if this post-October rally will keep on going...or rollover.

The CAC'40 at 3423 presently, will face SEVERE resistance around 3700 by late June/July. This of course is the time I expect the US markets to be peaking around 1550. Also, a move of 10% in the CAC, would match up perfectly with a further 8-10% in the SP' index. Things are really looking in sync' across a number of world indexes.

Of special note, the MACD (green bar histogram), will be very close to going positive cycle by mid April, and there should be a bullish cross of the MACD red/black lines. So, everything is set up for one final burst upward. One final thing that you can see in terms of the MACD, we've have two broad up cycles since the 2009 low. The coming third tower/+ cycle will be much smaller, and we should see a confirmed rollover by August/September. That would bode very well for at least a 3-6 month down cycle in the main indexes.

Germany – DAX'30

Germany has had a great first quarter - even though it was a difficult March for the EU, and ended positive. If there is one index in Europe that can break out to much higher levels, it is Germany. The MACD cycle will almost certainly go positive cycle at the beginning of next week - providing a pretty huge buy signal for the algo-bots for April and into early summer.

There will be strong double-top resistance around the 7600 level in the next few months. I'd guess we will fail there, and even the strongest EU nation/market will rollover in the latter part of the year.

United Kingdom – FTSE'100

The FTSE index had a moderately weak March, but the underlying trend is still positive, and just like Germany, looks set to go positive cycle in early April. I'd guess the FTSE is likely to go above the May'2011 highs, with a target around 6200/6400. That would again match up with the overall SP'1550 target, no later than July.

Hong Kong – Hang Seng'48

A weak month for Hong Kong, losing 5%, but underlying trend still looks upward (although weakening). A target of around 22/23k would seem the very best that the bulls can aim for.

Spain – IBEX'35

Spain is one of the weakest EU markets, a real economic basket case. With 50% youth unemployment, we have seen just this past week increasing social unrest. The Spanish people are getting moody, and with summer coming, it will only get much more 'dynamic' there. Bullish fire extinguishers, glazing companies, and rock miners?

The IBEX is very weak at 8000, however there is pretty easy upside to the 10MA around 8800. That's a good 10%..and again..this would match up with Sp'1550 by June/July. Eventually, I'd foresee the IBEX breaking under 7k..and that opens the door to a fast plunge to 5k.

USA – DOW'30

Six straight months up for the Dow, and it remains arguably the worlds strongest index. The MACD cycle has been positive for the past 3 months, and a few more positive months seem highly probable. In terms of price action, next target is upper bol' 13500, then a test of the 2007 bubble high of 14198. It is entirely possible that the dow will make a new high..briefly..as high as 14500/700 by July. A new dow high, to coincide with a facebook IPO? That would make for a near perfect marker point for a top.

Italy – Borsa'40

Italy is weak, but a test of the declining channel line around 17500 seems probable. The underlying MACD cycle looks set to go + cycle in April.

From a bigger perspective, you can see that Italy is still some 65% lower than the 2007 bubble era. A truly epic 'waste of time' for the buy & hold Italian investor. The Italian market is broken, and what will be very curious to watch is what happens if we break below the 13k level.

Japan – Nikkei'225

The bull flag that I mentioned in the first world-index report has been marginally broken above. First target remains 11k, and -assuming the bigger bearish outlook is correct, the 11k resistance will hold, with a move to the lower channel line of around 6k sometime in 2013.

China – the SSEC'50

There is an incessant amount of China doom talk out there. Even a Zerohedge posting on Friday was suggesting a China market crash is viable. Indeed it is, but - considering the near term outlook for the other world indexes, I believe it won't happen until at least Q3, or more likely Q4.

A move as high as 2600 seems viable in the coming few months, but it looks highly improbable that it can break and hold over the next huge psy' level of 3000. Just like in Italy, the really curious aspect is what happens if we break below 1700 - it would open the door to a further 45% fall to 1000. That will not please the amateur Chinese trader..they've had a rough 5 years already (down around 60%)..a move to 1000 would be a fall of 85% from the bubble peak. China social uprising in 2013?

Indexes - Summary

Greece: weak, long term decline continuing, only 15% left to go.

France: a 7/10% move up by early summer

Germany: a strong EU index, good chance of 10% upside

UK: on the threshold of breaking above the long term channel down trend.

Hong Kong: a few more moderate months higher..before rolling back lower at the upper channel line

Spain: weak weak, WEAK. An early summer bounce..before a major threat to breaking key 7k

USA: still super strong, a challenge to all time highs looks very likely, and even a brief break above.

Italy: a few months higher, underlying target/test of 13k...if fail..then...major collapse.

Japan: the basket case demographic mess, signs of a breakout, but..somewhat messy.

China: on the edge, but a bounce seems quite possible, before underlying econ-weakness fully appears.

In Closing

Despite the huge concern, the Greek 'Can' was successfully kicked ahead a few more months. Of course, attention is now shifting to the bigger PIIGS of Italy..and Spain. Spain will be the one to watch for all of 2012, will the government ignore the will of the people? Fridays announcement of huge public sector cuts sure is not going to help the social mood. Expect 'trouble' ahead in the sun baked streets of Spain.

With underlying momentum on most of the world indexes still crawling upward, we should expect April...and into the May-July period to show some broad gains..roughly between 7-10%. A few indexes will doubtless fall short or exceed this range.

Looking ahead, we will probably see more 'Green Shoots' talk in April. Earnings season will probably come in 'okay'. The maniacs on the various clown channels still have the biggest IPO to look forward to - the Facebook. A market peak around such a debut would make sense, and then...the next broad down cycle can begin.

I hope this overview was useful, as they say in the mainstream..'stay tuned'..more coming this weekend!

Good wishes

Welcome to the Weekend :)

Today was certainly not a bear massacre, however, neither were the bulls damaged. Considering it was end quarter, things seemed kinda quiet.

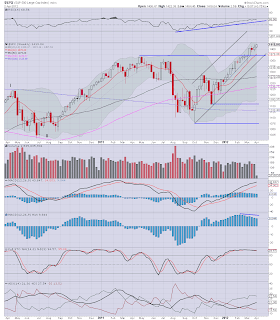

Dow'30 monthly

The Dow had another good month, not too much..not too little. The pace of uptrend is VERY consistent, and that's why I remain bullish. We pulled back during the month, but still closed higher, and that's a good sign for April.

Will April be rife with Green shoots? We have earnings season real soon, and that could be the catalyst to whack this market another 3-4% higher, enough to open the door to the target sp'1550 by late June/July.

Much more over the weekend. Good wishes

Dow'30 monthly

The Dow had another good month, not too much..not too little. The pace of uptrend is VERY consistent, and that's why I remain bullish. We pulled back during the month, but still closed higher, and that's a good sign for April.

Will April be rife with Green shoots? We have earnings season real soon, and that could be the catalyst to whack this market another 3-4% higher, enough to open the door to the target sp'1550 by late June/July.

Much more over the weekend. Good wishes

The Bigger Picture..into Q2

Tis late...lets take a brief look at where we are at...

SP' monthly

Yes, its been a shaky week for the bulls, but overall, we are surprisingly still positive on the sp'500 for this week and month Everything is set up for April for a move above 1440..which should guarantee a brief - and quick run to 1550.

VIX weekly cycle

VIX is still failing to close over the 10MA. If Friday is at least a moderately up day for the indexes, then VIX will again close another week poorly -although underlying momentum is still crawling back higher. Lower bol' is 10, so maybe that will be low in the coming weeks/months..

Prospects for Q2

Friday will be interesting to watch, a strong close for the markets would merely rub more dirt in the face of the remaining bears. Just how can they remain bearish whilst the monthly cycles are still cruising up in an almost straight line?

Earnings season will be here in just over a week, if the market decides those numbers are okay, then a move above sp'1440....seems highly probable. Such a move would smite another pack of bears, it could get real ugly...real soon.

Goodnight.

SP' monthly

Yes, its been a shaky week for the bulls, but overall, we are surprisingly still positive on the sp'500 for this week and month Everything is set up for April for a move above 1440..which should guarantee a brief - and quick run to 1550.

VIX weekly cycle

VIX is still failing to close over the 10MA. If Friday is at least a moderately up day for the indexes, then VIX will again close another week poorly -although underlying momentum is still crawling back higher. Lower bol' is 10, so maybe that will be low in the coming weeks/months..

Prospects for Q2

Friday will be interesting to watch, a strong close for the markets would merely rub more dirt in the face of the remaining bears. Just how can they remain bearish whilst the monthly cycles are still cruising up in an almost straight line?

Earnings season will be here in just over a week, if the market decides those numbers are okay, then a move above sp'1440....seems highly probable. Such a move would smite another pack of bears, it could get real ugly...real soon.

Goodnight.

End Q1..with a Friday Bear Massacre?

Hmm...lets take a look at the hourly cycle first...

SP'60min

A reasonably recovery for the bulls, the hourly cycle looks primed for further upside on Friday.

IWM'60min

IWM still closed red, but well off the lows. Cycle should go positive early Friday morning. There is the potential for ALL of Friday to be upward in trend. A Friday close of IWM anywhere over 84 would be a real failure for the bears.

VIX 60min - more fail

Kinda strange action in the VIX. Looks almost identical to yesterday. It reminds me of a cycle from some time ago, but I can't recall when, or what happened next. Regardless, Friday looks set to be a weak open for the VIX..with indexes moving higher.

Friday targets

SP, 1410/15 would be enough for the bull camp to declare another successful week. Anything under 1400 would be a problem. I will note there IS the real threat to the bears that Friday will actually turn into a massacre.

We have a few pieces of econ-data, if they come in okay, and the euro-indexes can move upward, a few good words from the Bernanke, then is a new SP' high possible? The immediate upside target would be around 1422/25.

For IWM, which I remain Long (via calls), anything in the high 83s would suffice, mid 84s would be a real victory, and open up a challenge of the key 86 (equivalent to sp'1440) next week..before the Easter Bunny arrives.

More later...

SP'60min

A reasonably recovery for the bulls, the hourly cycle looks primed for further upside on Friday.

IWM'60min

IWM still closed red, but well off the lows. Cycle should go positive early Friday morning. There is the potential for ALL of Friday to be upward in trend. A Friday close of IWM anywhere over 84 would be a real failure for the bears.

VIX 60min - more fail

Kinda strange action in the VIX. Looks almost identical to yesterday. It reminds me of a cycle from some time ago, but I can't recall when, or what happened next. Regardless, Friday looks set to be a weak open for the VIX..with indexes moving higher.

Friday targets

SP, 1410/15 would be enough for the bull camp to declare another successful week. Anything under 1400 would be a problem. I will note there IS the real threat to the bears that Friday will actually turn into a massacre.

We have a few pieces of econ-data, if they come in okay, and the euro-indexes can move upward, a few good words from the Bernanke, then is a new SP' high possible? The immediate upside target would be around 1422/25.

For IWM, which I remain Long (via calls), anything in the high 83s would suffice, mid 84s would be a real victory, and open up a challenge of the key 86 (equivalent to sp'1440) next week..before the Easter Bunny arrives.

More later...

Subscribe to:

Posts (Atom)