Whilst the main market is again back to churn mode for a few hours, lets take a quick look at the bigger picture, focusing on the Rus'2000 small cap index (via IWM etf).

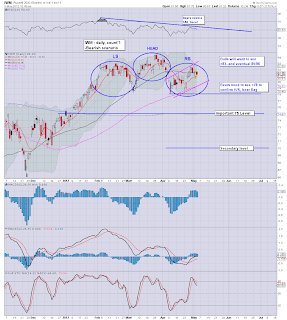

IWM, daily, bearish H/S scenario

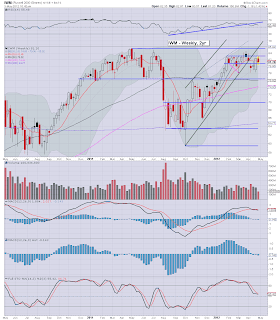

IWM, weekly

The daily cycle looks pretty good for a rollover. The weekly cycle looks like we've seen yet another failure to break/close over 83.00. Certainly, the 83.00 level is a great place for short-stops, for those with 'serious money'.

--

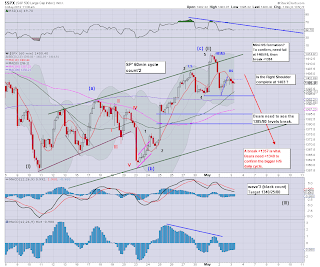

Sp'60min update

Is the RS complete? I don't know, it won't be clear until after the fact of course, much like almost all technical analysis. In terms of the SP', a break <1394 would be a real sign that theory was maybe correct, but even then, we need to put in a number of consecutive intra-day lower highs - especially tomorrow.

IWM, daily, bearish H/S scenario

IWM, weekly

The daily cycle looks pretty good for a rollover. The weekly cycle looks like we've seen yet another failure to break/close over 83.00. Certainly, the 83.00 level is a great place for short-stops, for those with 'serious money'.

--

Sp'60min update

Is the RS complete? I don't know, it won't be clear until after the fact of course, much like almost all technical analysis. In terms of the SP', a break <1394 would be a real sign that theory was maybe correct, but even then, we need to put in a number of consecutive intra-day lower highs - especially tomorrow.

No comments:

Post a Comment