The indexes are moderately higher, but we are still within the broader range of the RS - as defined by the daily chart (see earlier post). There doesn't seem likely to be anything to move this market until AH, when we have earnings from AMZN.

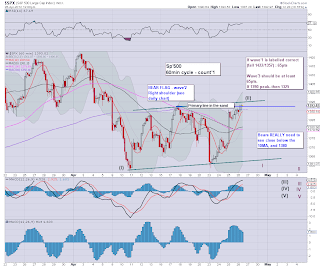

Sp'60min

A move over 1395/97 would be real bad for the bears. A close of 1400 would arguably be decisive. From a MACD (blue bar histogram) cycle perspective we have been cycling lower for some 6 hours..and yet prices have still been trending a little higher. That has to be a concern, although Vix has been green at times this morning.

-

Holding to earlier targets, Bears need to see a break under the 10MA 1389.

Its turning out to be a really quiet day, I guess most traders are waiting for the GDP (and other bits) tomorrow morning.

Sp'60min

A move over 1395/97 would be real bad for the bears. A close of 1400 would arguably be decisive. From a MACD (blue bar histogram) cycle perspective we have been cycling lower for some 6 hours..and yet prices have still been trending a little higher. That has to be a concern, although Vix has been green at times this morning.

-

Holding to earlier targets, Bears need to see a break under the 10MA 1389.

Its turning out to be a really quiet day, I guess most traders are waiting for the GDP (and other bits) tomorrow morning.

No comments:

Post a Comment