Mere minutes after my 10am update we saw a snap up, breaking over the little bear flag. Clearly, a lot of bears just got kicked out, and are now spooked. Doubtless, many of them will also be concerned that AAPL will post 'better than expected' earnings after the close.

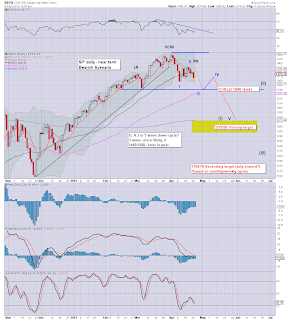

However, the daily cycle is clear, and there are two major levels the bull lunatics need to CLOSE above just to have a chance at reversing yesterdays confirmed bear flag break. First, the 10MA of sp'1376, and the 50MA of 1380.

Sp'daily

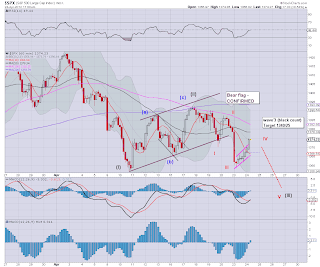

Sp'60min

Considering we've already have a pretty significant bounce from yesterdays floor, surely we are going to rollover before the close?

The wave count is really confusing right now, was yesterday merely wave'1 down? If that's the case, there is still a long way to go, at least sp'1300 within 3-7 trading days. If instead today is the top of wave'4, then that would likely mean we floor post FOMC around 1340. I suppose that could merely be the floor of the main wave'3 - with a 4 & 5 to come in May (see daily chart).

As ever, we'll just have to wait and see. What seems critical is what happens when we get near 1340/45, whether its tomorrow, or a few days later.

However, the daily cycle is clear, and there are two major levels the bull lunatics need to CLOSE above just to have a chance at reversing yesterdays confirmed bear flag break. First, the 10MA of sp'1376, and the 50MA of 1380.

Sp'daily

Sp'60min

Considering we've already have a pretty significant bounce from yesterdays floor, surely we are going to rollover before the close?

The wave count is really confusing right now, was yesterday merely wave'1 down? If that's the case, there is still a long way to go, at least sp'1300 within 3-7 trading days. If instead today is the top of wave'4, then that would likely mean we floor post FOMC around 1340. I suppose that could merely be the floor of the main wave'3 - with a 4 & 5 to come in May (see daily chart).

As ever, we'll just have to wait and see. What seems critical is what happens when we get near 1340/45, whether its tomorrow, or a few days later.

No comments:

Post a Comment