It is always a constant struggle to not get overly permabearish, but this mornings Chicago PMI number is again a reminder of just how lousy things are. Japan is in a deep recession, various parts of the EU (not least Greece, UK, and now Spain!), and I'm still guessing... the USA will follow. The question is how long until the USA gets infected, six months, or maybe not until 2013? Anyway, that's a very long term issue, but in the meantime, we do have some market weakness to both start the week and end this month.

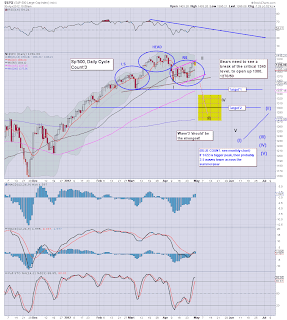

Sp'daily - bearish outlook

The H/S formation - with the bear flag (pink lines, within the RS) is certainly an interesting possibility. If it is correct, we'll know within a few days. A break under 1357 would arguably still only be a preliminary confirmation. To be confident, bears need SP <1300. First things first though, lets see how we close today.

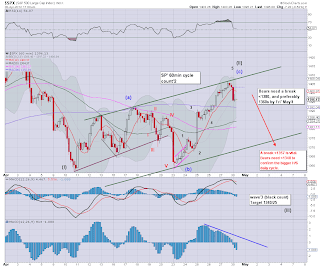

Sp'60min

The break below the 10MA is indeed important, bears will need a daily close under it, preferably in the 1380s - although is probably asking a great deal for today.

More later!

Sp'daily - bearish outlook

The H/S formation - with the bear flag (pink lines, within the RS) is certainly an interesting possibility. If it is correct, we'll know within a few days. A break under 1357 would arguably still only be a preliminary confirmation. To be confident, bears need SP <1300. First things first though, lets see how we close today.

Sp'60min

The break below the 10MA is indeed important, bears will need a daily close under it, preferably in the 1380s - although is probably asking a great deal for today.

More later!

No comments:

Post a Comment