Urghh, another day that was not only dull, but it was another dose of pain for the few bears that remain.

Sp'weekly....unquestioningly..strong

The uptrend continues - although momentum is very slowly reducing (at current rate, will take 2-4 months to go negative cycle).

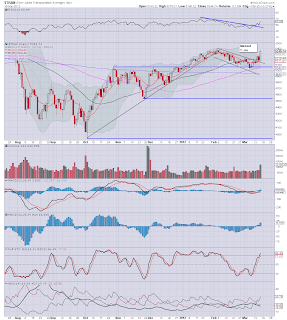

Transports, daily - yesterday was a small tease for the bears

There had seemed a slim possibility that the small move yesterday was the start of something. Clearly, today's action was very bullish. The next target remains making a new high in the 5500s.

VIX - daily....churning in the 15s

Nothing much can be gleaned right now from the VIX. The cycle momentum looks possibly flooring, but it could just as easily churn in the low teens for weeks to come..even months. Only a break over 19 would suggest anything remotely bearish for the main indexes is possible.

Awaiting the weekend

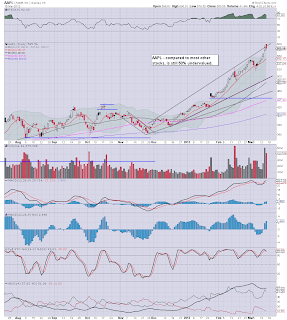

Well, the only marginally interesting aspect today was AAPl. $600...but closing at 585. Dare I note, but Cramer on clown channel made a good point. If you just divide the price by 10, and look at it that way, the move from 35 to 60 is really not that extreme. We have indeed seen plenty of stocks over the years double and triple up in months. Considering the PE (12/13), AAPL could indeed hit $1000 - and still only be 'average value' compared to rest of the market.

OPEX Friday, not expecting anything other than a repeat of today.

*Ohh, and one note on the 'doom chatter' out there. Much of it is valid, in the arguments they make about possible black swans - whether an Iranian conflict, or a EU implosion, yet as the last few days have again shown....the market can simply ignore the threat of any of it,...for a very very long time.

Goodnight

No comments:

Post a Comment