Its late, so this will be the last posting before tomorrow!

Here are 3 charts that should inspire any bear, and possibly make any permabull question whether the cheerleaders touting sp'1500/1700 for this year have a chance.

The FTSE 100 index -monthly

The European indexes have been more clean - and respectful of chart theory than the US indexes (due to less manipulation, or trader delusion?). Whatever the reason, a very clear H/S formation is apparent since the March 2009 low.

Ultimately, a break below the 4750 would confirm the pattern, and open the door to a full test of the original low.at the 3500 level.

*I intend to look at all the major world indexes, probably in a weekend post.

--

CRX - The commodity equity index

The CRX remains one of the near perfect bearish charts out there still. We did briefly break back above last summers old support - now resistance levels. We are very close to major snap levels. A 75/100pt fall to the low 800s is very possible by end of next week.

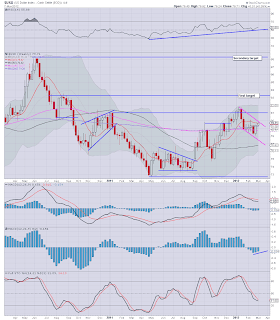

US Dollar index - near term

Bears would prefer to see 80.25 to suggest the bull flag is confirmed. 82 would completely confirm the theory, and open up the targets of 83 and 88. A move above 90 would be especially devastating for the metals.

-

Okay, that will do for tonight.

Goodnight!

No comments:

Post a Comment